en

en  Español

Español  中國人

中國人  Tiếng Việt

Tiếng Việt  Deutsch

Deutsch  Українська

Українська  Português

Português  Français

Français  भारतीय

भारतीय  Türkçe

Türkçe  한국인

한국인  Italiano

Italiano  Gaeilge

Gaeilge  اردو

اردو  Indonesia

Indonesia  Polski

Polski The topic of cryptocurrencies as such is perhaps one of the most discussed in the world in recent years. The huge opportunities that blockchain opens up for users cannot be overestimated. But cryptocurrencies are not only an alternative option for storing personal funds but also a great way to make a profit. There are plenty of options for earning money in cryptocurrencies, but one of the most buzzed about in the last year is crypto arbitrage. For those who are not familiar with what is crypto arbitrage, as well as for those who have heard about it but do not know how it works, we have prepared today's material. We will talk in detail about what types of crypto arbitrage exist, how crypto arbitrage works, potential risks, and how proxies can help you earn more and bypass various restrictions. Let's get started.

To begin with, it's worth getting straight into how cryptocurrency arbitrage works and what exactly people make money from. Like any other type of arbitrage, it consists of reselling a product for the benefit of the arbitrageur. In the case of cryptocurrencies, you need to buy and sell the crypto with the difference. But at first glance for someone new in this field it may not be obvious, because it is not quite clear how you can sell bitcoin with different prices or USDT with different prices. This is the beauty of cryptocurrencies because since you can transfer funds, including between different exchanges, almost instantly, it allows you to earn on the resale of the same bundles. Crypto arbitrage trading allows you to make money on the differences in the price of crypto, your task is only to look for or use such bundles that allow you to make a net profit and earn on crypto exchanges.

If we try to explain in a few sentences what cryptocurrency arbitrage is - it is the purchase of an asset on an exchange, and the goal is to sell the same asset somewhere where the demand for it is lower and the price is correspondingly higher.

This type of arbitrage is actively developing because you don't need any proof of income, checks from banks, and other complications that a regular swift transfer creates. Although many countries are slowly trying to regulate the flow of cryptocurrencies, at the moment, when you deposit funds to your cryptocurrency wallet, you can safely make many transactions and be invisible to banks. Problems may arise only when withdrawing these funds to real bank cards and in a few other cases, which we will also talk about further. But at the moment it is a great way to earn money every day if you have the necessary knowledge in the field it will turn into a routine process and every month you can only increase your income. Our task today is to familiarize you with the basics of crypto arbitrage and show you how it works with examples.

Before jumping into the types of crypto arbitrage, we need to understand a few basic things. First, we need a basic understanding of the principle of P2P.

P2P means person-to-person or peer-to-peer, which implies a transfer from one person to another. Since such a request is quite popular, at the moment there is a very large number of sites that provide opportunities for such an exchange of funds from person to person. Beneficial such transactions, in this case, can be both for the buyer and the seller because you are not limited to putting an offer at the price you are interested in. Accordingly, the earnings on P2P are just to find a favorable for you offer and then perform resale, but with a different, more favorable rate.

Secondly, you need to consider the risks involved in such transfers. The point is that the platform on which you make the exchange, simply acts as an intermediary in the transaction, and the successful completion of the transaction directly depends on both of its participants. Risks appear here only if one of the parties did not fulfill the terms of the transaction and, accordingly, it was not successfully closed, which can lead to loss of funds, because quite often bundles in crypto arbitrage do not live long and such an unsuccessful transaction can be followed by loss of funds. There are also various tricks and scam techniques on crypto exchanges, which scammers use to deceive users during the exchange, but we will talk more about this a little later.

Now that we have sorted out the most basic points, we can move on to the types of crypto arbitrage.

An interesting feature of crypto arbitrage is that you can earn in this field in different ways. There are both opportunities to limit yourself to working on one exchange and involving quite a large number of different pairs of cryptocurrencies, foreign exchanges and even different bank accounts. Usually, the more complex and interesting you can come up with a bundle, the more likely it is that you'll be able to earn a decent percentage per one circle on it. But this doesn't always work either, as you need to realize that you will successfully go through all the stages of translation, there will be no difficulties anywhere and the bundle is really worth the time and effort. Therefore, we recommend starting with the simplest options, and as you gain experience and capital, increase the complexity, and look for more and more options. Let's see what types of cryptocurrency arbitrage exist:

Intra-exchange arbitrage consists of reselling some cryptocurrency on the same market. It works since there may be several markets on a certain exchange, or due to the possibility of buying some crypto for real currency (Fiat) and reselling it for a profit. On the stock market you can see the price of a certain cryptocurrency, say 1.3$ at your current exchange rate, and on P2P you can sell it for 1.4$. This is the difference, but the problem is that this way of arbitrage is very difficult to make a good profit, because on P2P platforms the price is usually also on average equal to the rate on the stock market. Therefore, you should not expect big percentages that you can get from each round, you can earn well in this way only by having a very large bank, as well as processing all the orders that you place on P2P, which will also take some time for you. So it is a full-time job and you need to view it that way. Nevertheless, if you have a large starting capital, then this is probably the safest and easiest way to make money from cryptocurrency arbitrage, but it is quite rare for beginners to have a good starting capital. That's why a lot of people use other methods of arbitrage, which we will talk about next.

This type is already a more profitable method of arbitrage because it requires working with several exchanges at once. The point is that you buy an asset on one of the exchanges and sell it on another at a more favorable rate. The logical question in such a situation is where does this difference come from? The idea is that trading on the exchanges is quite active, and therefore on one of the exchanges there may be a large demand for any of the assets, which will reduce its price, and on another exchange the demand may be lower and the price for the same asset will be higher. It looks like an ideal way to earn income, where the main requirement is to search for various smaller exchanges and monitor the price of a certain asset on them, but there are also problems here and it's not easy to sell crypto with different prices. First of all, you should always take into account the commission on transfers, if any, and calculate the profit taking this factor into account. Secondly, at the moment there are quite a lot of bots working on exchanges, which are constantly looking for such loopholes, which arbitrageurs take advantage of. Therefore, in this method of arbitrage is quite important to quickly close transactions, because any delay can lead to the fact that the loophole will be inactive.

International arbitrage is probably the most profitable type of crypto arbitrage at the moment. It is beneficial because if you understand the market well enough, you can make a good profit taking into account the economic situation in the world. More specifically, you will also need to consider the exchange rates of different countries and look for loopholes there. Say, using your local currency you can buy USD, send it to another country, then buy the same USDT there and withdraw it back to the local currency. There are quite a few pitfalls here too, as it's dealing with currencies and international transfers, and it's not as easy to do as a regular cryptocurrency transfer on an exchanger. You will also need foreign bank cards and verified KYC (Know your customer) accounts on exchanges where identity verification is mandatory. Therefore, despite the highest benefits of all three methods, you will also need a lot of additional instruments, and not all of them can be easily obtained.

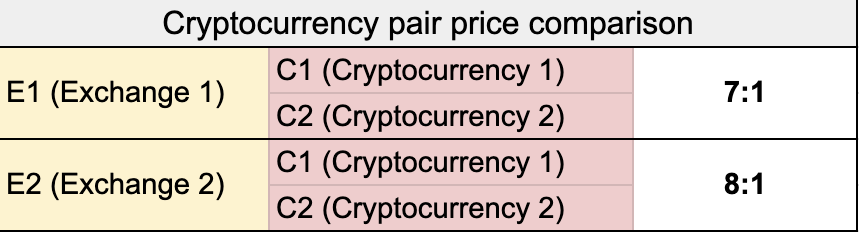

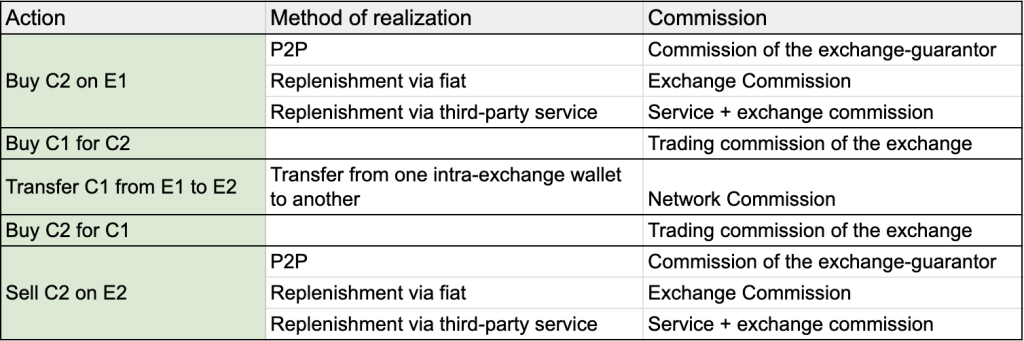

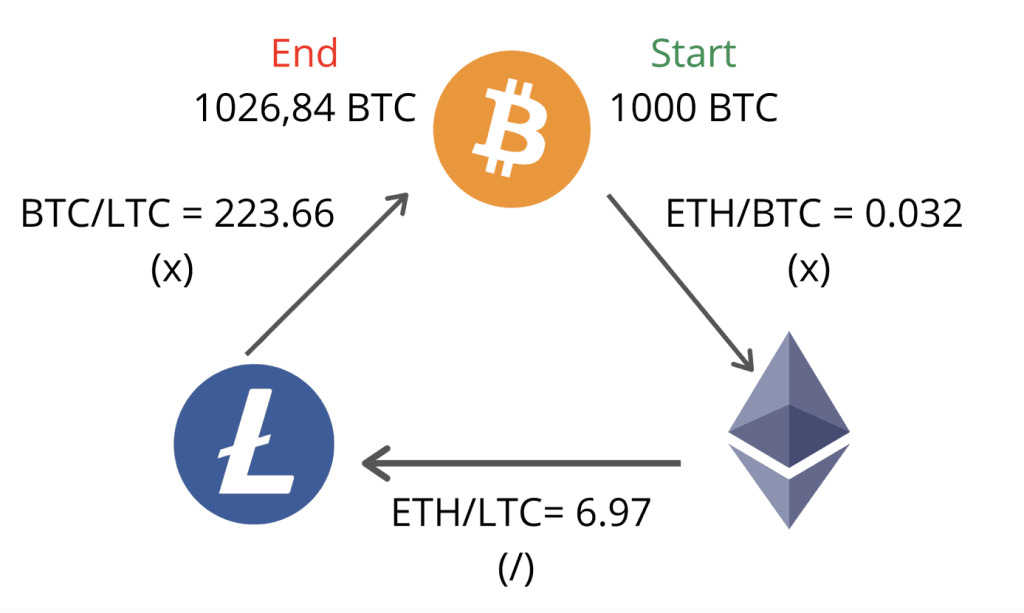

We now propose to look at specific bindings in action and the algorithm of operations.

To fully understand how to do crypto arbitrage, we will show the process of a full circle, all the steps, and specific numbers you can earn from one such circle on the example of a P2P bundle. But remember that there are different bundles, you can earn a higher percentage or lower, and the amount of earnings will directly depend on your deposit, which you transfer. But for you to understand the whole principle of work, we will show you all the steps.

The designations here are as follows:

If at recalculation of all commissions at all stages we still get profit, then the bundle is working and we can proceed to its realization.

We have given an example of a simple bundle, where we also showed how you can implement it through several exchanges, but in general, you are not limited to modifying these bundles as you see fit. For example, if you see that by adding + several more exchanges or even banks of different countries with different currencies you have additional profit, then you can and should do it if you see enough that it is quite realistic to make such a deal. All the profit in the sphere lies in finding the difference between various trading assets, whether it is cryptocurrency or real national or international currency. Cryptocurrencies open up ways for you to transfer funds quickly, but a large enough percentage of your profit will be in finding non-obvious schemes, and that is the job of an arbitrageur.

Now it's time to talk about the risks that exist in this sphere, and there are quite a lot of them, so all these things are also important to understand when you enter the cryptocurrency market.

At the initial stage, try to conduct transactions with a small bank until you are sure that some of the bundles you have found work, or at least until you understand exactly how all the steps of transferring funds work and go through them yourself several times.

There are a lot of such schemes, we have given only some of them as an example, but most often such schemes play on the inexperience or inattention of the user, so always double-check the correctness of all the conditions of the transaction you are conducting.

Therefore, work only with large and trusted exchanges, and always remember that huge spread percentages rarely exist and most often it is just a scam. Build your expectations of earning realistically, and take into account that to earn 2-3% percent of the spread for one round is considered an excellent result.

But are there any real ways to somehow scale your income in cryptocurrency arbitrage using supporting tools? Yes, there are such ways, although they are not the most obvious. But proxy servers can help you in this case, as well as anti-detect browsers, using which you can get some boost in arbitrage. What kind of boost? Let's take a look at a few specific cases of using proxy in arbitrage.

Proxies can help you bypass bank restrictions on crypto exchanges, as it is unlikely that you will be able to use more than one account for your credentials. However, if you have friends or relatives whose credentials you can register additional accounts with, significantly speeding up the arbitrage process by conducting more rounds from different accounts, you will also need proxies and separate profiles in anti-detection browsers so that you can have a separate IP address for each account to access crypto exchange. Multi accounting in crypto arbitrage is cut off by almost all major crypto exchanges, so here you should also be quite careful in choosing proxy servers.

Also, proxies are quite often used to bypass crypto exchange restrictions, such as regional restrictions. At the moment, even major exchanges like Binance may not be available in some countries, or they may not have the option to deposit any sub-sanctioned currency. Therefore, in such a situation proxy servers become an indispensable tool, because you can change your IP address to a country where there are no such restrictions, and very many arbitrageurs work daily in this area using proxies.

Another non-obvious way to use proxies in arbitrage is to try to find an IP address as close as possible to the servers of a particular exchange. Why, you may ask? It is done so that your delay concerning the exchange becomes the minimum possible, which will allow you to conduct transactions a little faster, but in the case of crypto arbitrage, it can play a significant role.

But there is a logical contradiction here because logically when using any proxy server, you increase the number of transit connections, thus the ping will be higher than it was before. This is quite a reasonable point, as the essence of proxies is exactly that, but in our case they can help the arbitrageur if a proxy close to the exchange is chosen. The point is that in theory, increasing the number of intermediate "points" should increase the delay, but in practice, it is somewhat different - the quality of interactions between these "points" plays a role. It happens that a path of 3 points transmits packets slower than a path of 10. This is why proxies are used by arbitrageurs for such a task - the ability to build a new connection route that may be faster.

Now that you know quite a lot of information about cryptocurrency arbitrage, all you have to do is start practicing and learning all the other pitfalls in the process. The field is too big to cover everything in one material, but if you can master the basic principles and put them into practice, you will see that it works and you can make money at it. The result will depend on the amount of time invested, starting capital, your diligence, and your understanding that the awareness of many things will come only with mistakes, which you will have in any case. Therefore, be prepared for this and build your expectations of earnings in this area realistically, so that you always clearly understand what you can count on. And do not forget that if you want to bypass the restrictions of crypto exchanges in any way, you can not do without proxy servers, which in this case serve as an indispensable tool.

Comments: 1